The recent surge in the stock market has taken many of Wall Street’s seasoned strategists by surprise, prompting a flurry of activity as they rush to reassess their forecasts for the S&P 500.

As we entered 2024, the prevailing sentiment among investment banks and research firms was one of cautious optimism, with expectations of modest gains in U.S. stocks following the remarkable performance of 2023. However, lingering concerns over interest rates and inflation cast a shadow of uncertainty over the market’s trajectory.

Yet, these apprehensions were swiftly dispelled as a fresh wave of enthusiasm surrounding artificial intelligence and the Federal Reserve’s steadfast commitment to its monetary policy paved the way for a relentless climb in stock prices.

The evidence is compelling: the S&P 500 has notched its 20th all-time high this year, while both the Nasdaq Composite and the Dow Jones Industrial Average have also reached impressive milestones. This remarkable rally has caught many forecasters off guard, compelling them to adjust their projections for the future trajectory of U.S. equities.

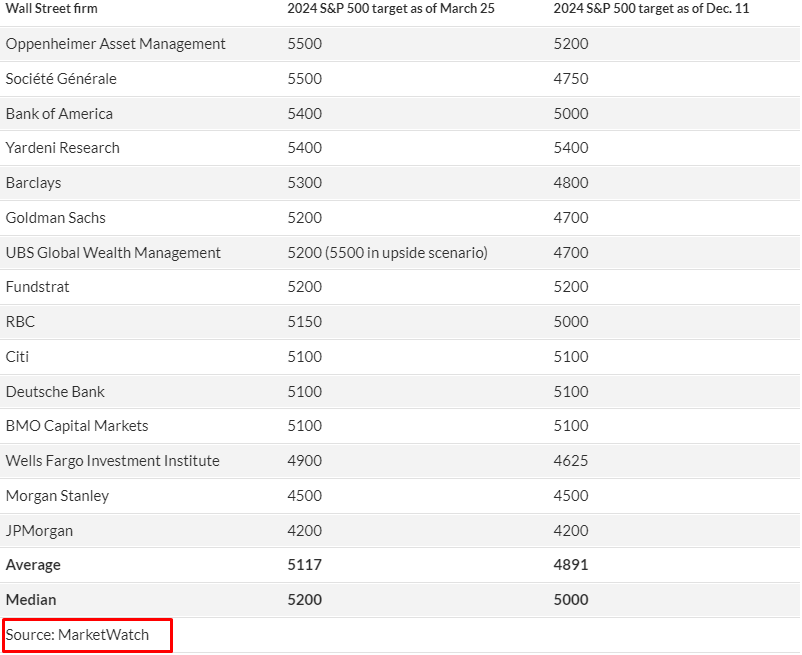

In the past couple of months alone, at least six major Wall Street banks have revised their S&P 500 targets upward, reflecting a newfound sense of optimism and confidence in the market’s potential for further growth.

On Monday, Oppenheimer Asset Management raised its year-end target for the S&P 500 from 5,200 to 5,500, signaling potential growth of over 5% from Friday’s closing level of 5,234.18. According to a team of strategists led by John Stoltzfus, the firm’s chief investment strategist and managing director, this decision was supported by positive earnings trends in recent quarters, the resilience of economic growth, and a noticeable shift in sentiment among bearish investors.

Oppenheimer’s bullish target of 5,500 stands out among other major Wall Street institutions tracked by MarketWatch. Société Générale also increased its year-end target to 5,500 from 4,750 on Thursday.

In a similar vein, Bank of America’s Savita Subramanian and strategists at Barclays recently joined the optimistic camp by setting their year-end targets at 5,400 and 5,300, respectively. They cited economic resilience and strong earnings from tech giants as reasons behind their forecasts.

Goldman Sachs, in February, revised its forecast to 5,200, aligning with other bullish forecasters such as Fundstrat’s Tom Lee, who also predicts a 5,200 finish. Despite the varied targets, the median estimate for the S&P 500 by the end of 2024 stands at 5,200, indicating a marginal decline of less than 1% from Friday’s levels, according to MarketWatch calculations. This marks a notable shift from the median target of around 5,000 heading into 2024.

Despite the optimism surrounding the stock market in 2024, there are still voices of caution. Morgan Stanley’s Michael Wilson stands firm with a year-end S&P 500 target of 4,500, remaining one of the most pessimistic strategists on Wall Street. Similarly, JPMorgan Chase predicts the index to finish the year at 4,200, marking the most bearish projection among major firms.

It’s important for investors to take these forecasts with a grain of salt, considering Wall Street’s track record. Analysts largely failed to anticipate the stock market rally in 2023, with their predictions falling short of where the S&P 500 actually ended up.

Taking a closer look at a bottom-up approach, John Butters from FactSet Research analyzed company-level estimates aggregated by industry analysts. Historically, these analysts have tended to overestimate the S&P 500 by about 3% to 8% on average over the past two decades. However, in recent months, they have actually underestimated the index’s closing price.

For instance, a year ago, the bottom-up target price was 4,635.48. But based on Wednesday’s closing figure of 5,224.62, industry analysts underestimated the S&P 500’s closing price by over 11%, highlighting the challenges of forecasting in dynamic market conditions.

Credits:www.marketwatch.com