U.S. stocks retreated from earlier gains as bond yields climbed, with investors shifting focus from the aftermath of Iran’s attack on Israel to the start of earnings season:

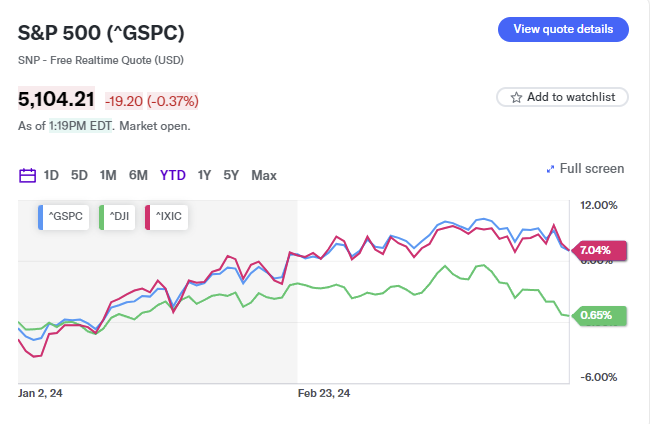

The S&P 500 (^GSPC) slipped into negative territory, while the Dow Jones Industrial Average (^DJI) hovered near the flatline as both indices erased earlier advances. The tech-heavy Nasdaq Composite (^IXIC) declined by 0.4% after opening higher.

The 10-year Treasury yield (^TNX) rose to 4.62% as traders moderated expectations for Federal Reserve interest rate cuts this year.

Retail sales data released on Monday showed a 0.7% increase in March compared to the previous month, surpassing economist forecasts of a 0.4% rise, indicating sustained consumer spending despite higher interest rates.

Stocks faced pressure in recent days as earnings season began on a subdued note and concerns lingered over inflation remaining below the Federal Reserve’s 2% target.

Initially, investors brushed off worries of escalating conflict in the Middle East following Iran’s missile and drone strike on Israel on Saturday. U.S. efforts to dissuade Israeli retaliation helped calm nerves, especially as the well-anticipated attack limited damage.

Oil prices fell over 1% on Monday after rising ahead of Iran’s airstrike. West Texas Intermediate crude futures (CL=F) traded around $85 a barrel, while Brent futures (BZ=F) approached $89.

Safe-haven gold (GC=F) slipped after rising by as much as 1.2% last week amid Middle East tensions.

In corporate news, Goldman Sachs (GS) kickstarted the week’s earnings on a positive note, with shares of the Wall Street firm rising up to 5% after first-quarter profits exceeded expectations.

Tesla (TSLA) shares declined by as much as 3% after the electric vehicle maker announced staff reductions amid a broader slowdown in EV growth.

Credits: yahoo.com