The yen, under considerable pressure and nearing a critical juncture near a 34-year low, is being closely monitored by Japanese authorities. Standard Chartered predicts that these authorities will likely hold off on intervention until after the release of US inflation data later this week.

As of 4 p.m. in New York, the yen was trading at 151.83 per dollar, just shy of this year’s low of 151.97 per dollar and the key psychological level of 152. Analysts believe that breaching this level could prompt Japanese authorities to take action. However, Standard Chartered’s strategists anticipate policymakers to keep their intentions ambiguous as they await the March inflation figures on Wednesday. They caution that a higher-than-expected US Consumer Price Index (CPI) could trigger increased dollar buying.

“If the US CPI data comes in stronger than expected, we believe the Bank of Japan (BoJ) might hold off intervening until selling pressure has been exhausted,” wrote FX strategists Steve Englander and Nicholas Chia in a research note on Monday. They noted that significant yen selling might prompt intervention closer to the 153 level.

In the event of intervention, the strategists suggest that the BoJ may need to commit more resources than the $60 billion spent during interventions in September and October 2022. “Similar to snacking, a small intervention is often insufficient,” they added.

Prime Minister Fumio Kishida’s upcoming visit to the US this week could see Washington expressing support for any policy actions, although Standard Chartered places the likelihood of joint intervention at only 20%.

“Any FX intervention would likely be a unilateral effort by Japan, possibly with tacit approval from the US,” Englander and Chia explained. Conversely, a softer US CPI reading could provide some relief to policymakers.

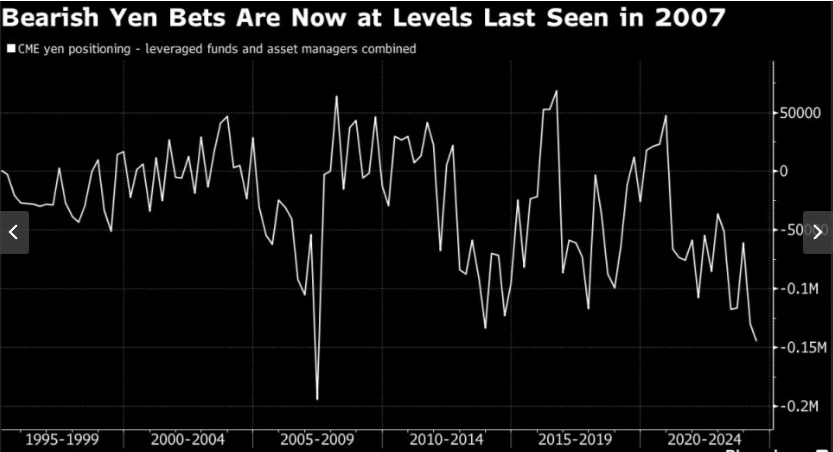

The significant increase in short yen positions held by leveraged funds and asset managers, now at a 17-year high, exposes currency bears to potential shifts in the opposite direction, cautioned the strategists.

Credits: finance.yahoo.com